Consult the new IRS withholding tax tables for 2025 here.

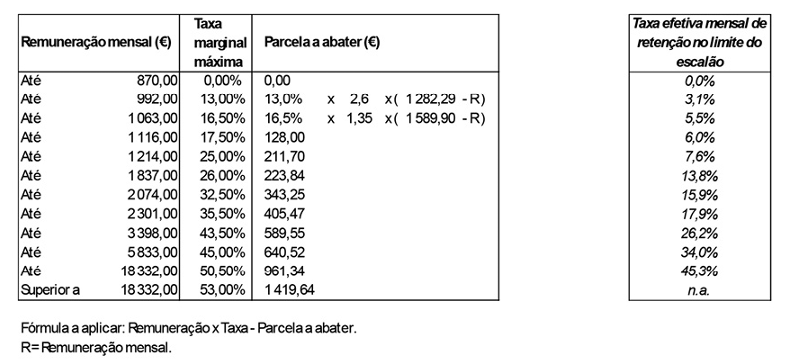

The Government has published the new IRS withholding tax tables for 2025, ensuring exemption for incomes up to 870 euros per month. Consult them in full next.

These are the new IRS withholding tables in force in 2025.

The Ministry of Finance released the updated IRS withholding tax tables, which will be in effect throughout 2025. Published in the Official Gazette, the new tables come into effect in time for the processing of the first salaries of the year.

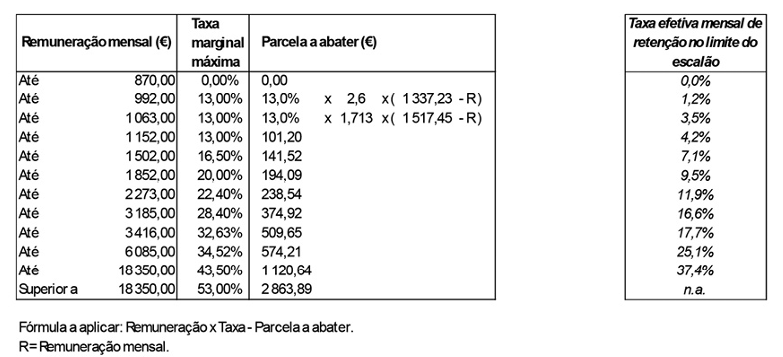

These changes ensure that dependent workers and pensioners with income up to 870 euros per month are exempt from monthly retention. See the full tables below.

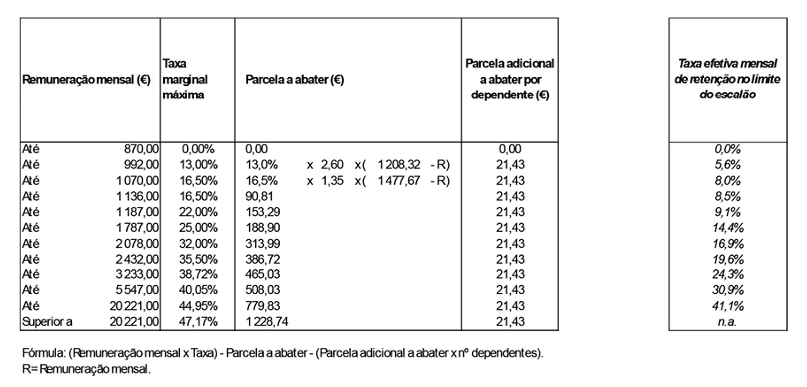

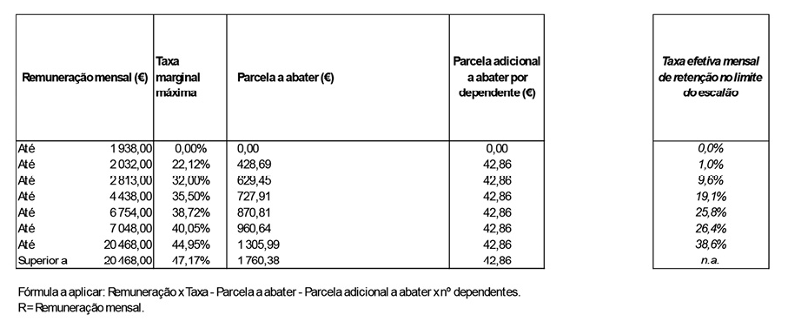

Table I - Dependent work: Unmarried with no dependents or married with two holders.

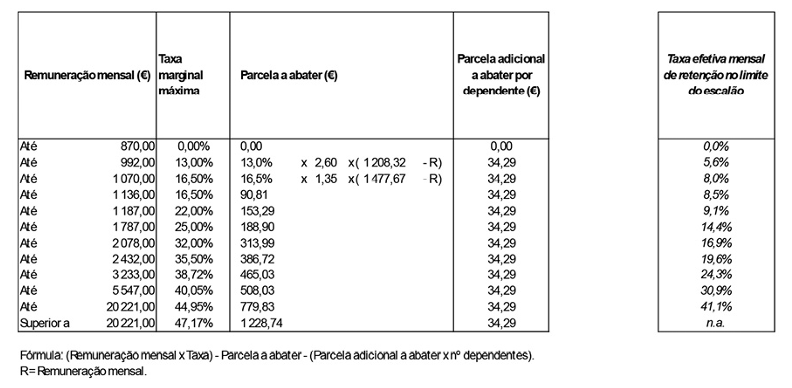

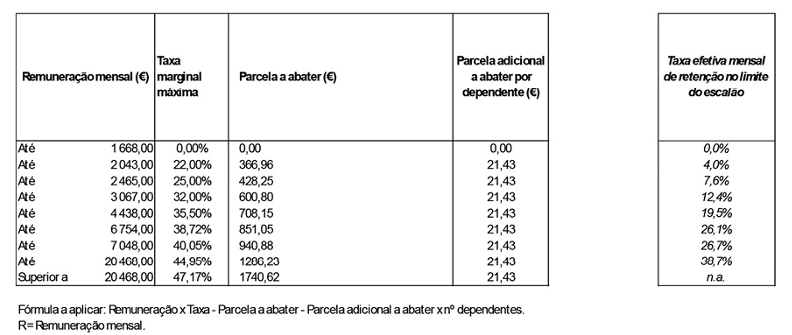

Table II - Dependent work: Not married with one or more dependents

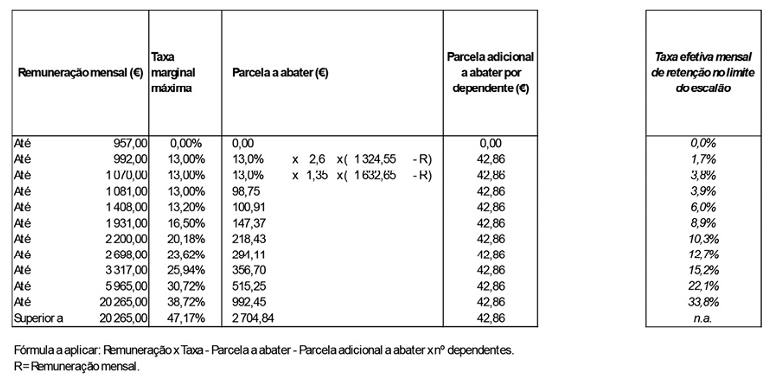

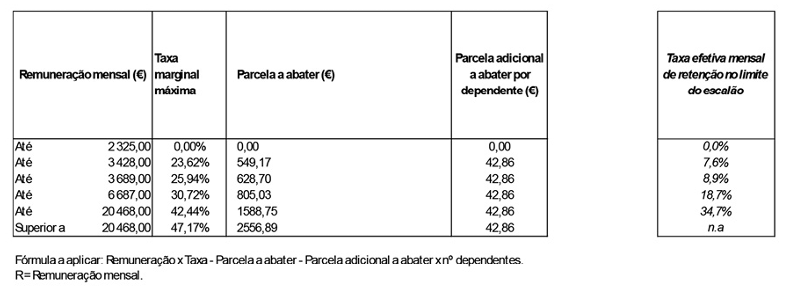

Table III - Dependent work: Married, sole holder

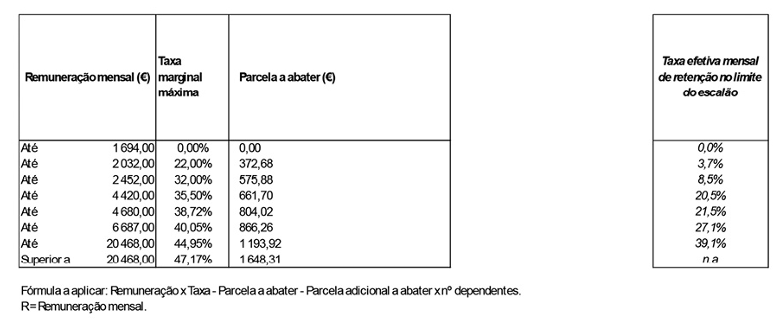

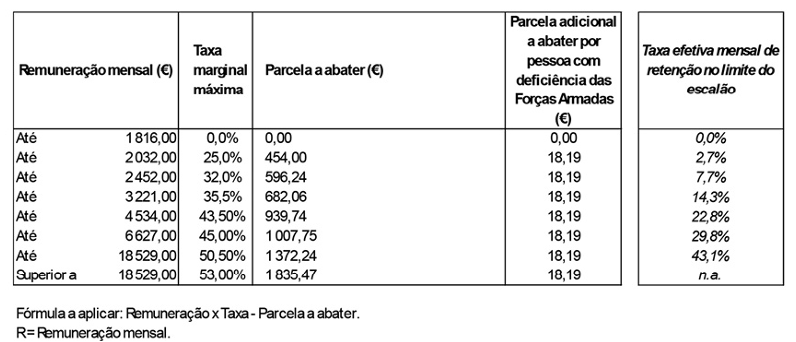

Table IV - Dependent work: Not married or married two holders without dependents - Person with disabilities

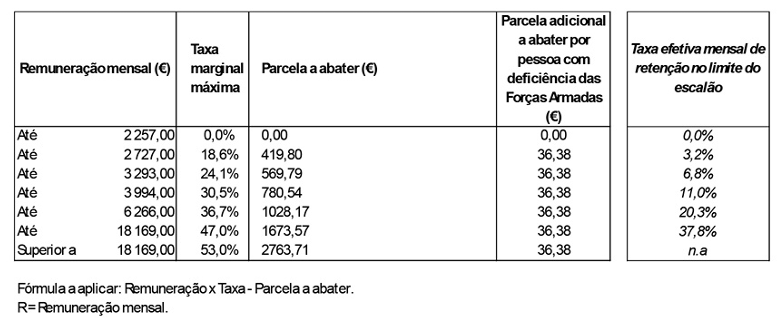

Table V - Dependent work: Single, with one or more dependents - Person with disabilities

Table VI - Dependent work: Married two earners, with one or more dependents - Person with disabilities

Table VII - Dependent work: Married sole owner - Person with disabilities

Table VIII - Pensions: Single or married with two holders

Table IX - Pensions: Married sole holder

Table X - Pensions: Unmarried or married with two holders - People with disabilities

Table XI - Pensions: Married sole holder - Person with disability

Consult all tables in full on the Finance Portal.

Also read: Green receipts: Find out if you can be exempt from withholding tax

Don't forget to follow the Poupança no Minuto if you want to stay up to date with tax news.