8 applications to organize your finances.

Need to have better control over your wallet? You can organize your budget to maximize your income through financial organization apps. Get to know these 8 that we have put together for you.

If you want to reduce your budget by decreasing the amount you pay for loan installments or insurance, turn to a credit intermediary/insurance mediator like Savings in a Minute. But first, get to know these financial management applications.

Discover 8 financial organization apps

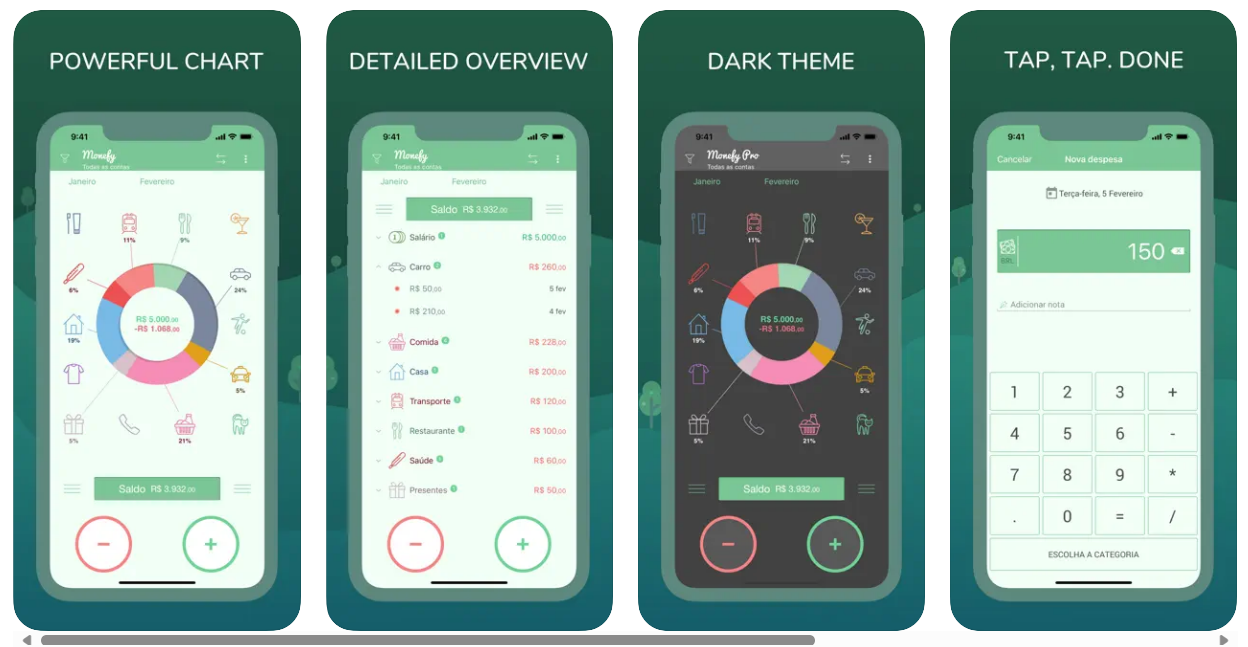

Monefy Personal Finances app available on the Apple Store for Portuguese users: https://apps.apple.com/pt/app/monefy-finan%C3%A7as-pessoais/id1212024409

The strengths of Monefy lie in its ease of use, being an intuitive application that allows the use of different currencies. Through a chart, you can keep track of your expenses in each category, use the budget mode, input multiple bank accounts, and also have access to a calculator embedded in the app.

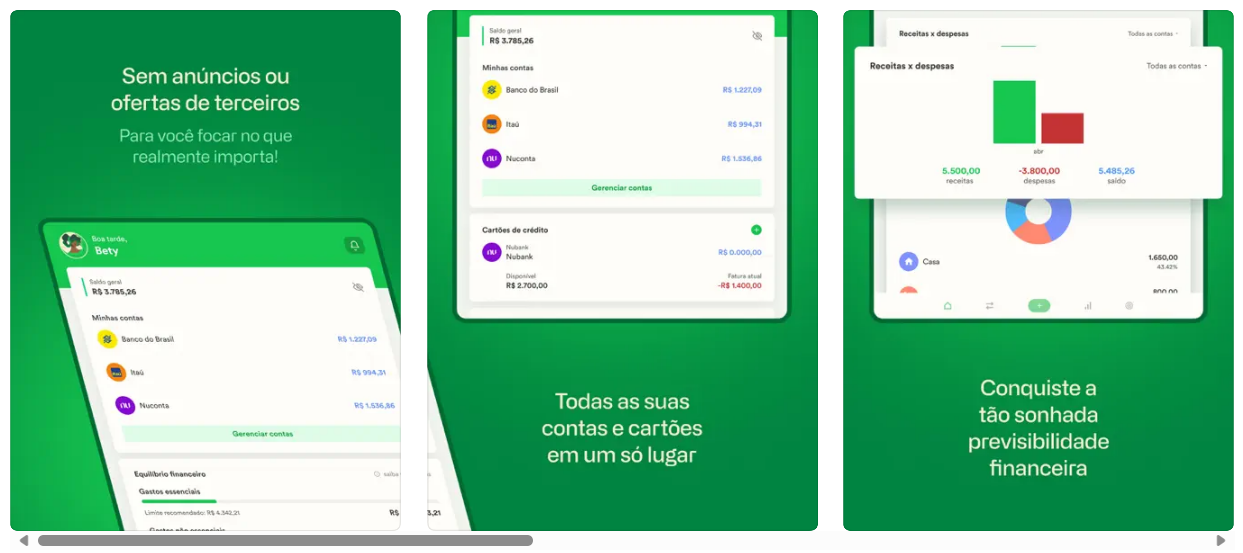

Translate Organizze to English.

With Organizze, you can control your money in real time, gathering all your financial life in just one app. You can link all your bank accounts, manage credit card bills, forecast expenses, and track your spending more closely. You can even share financial records with a partner.

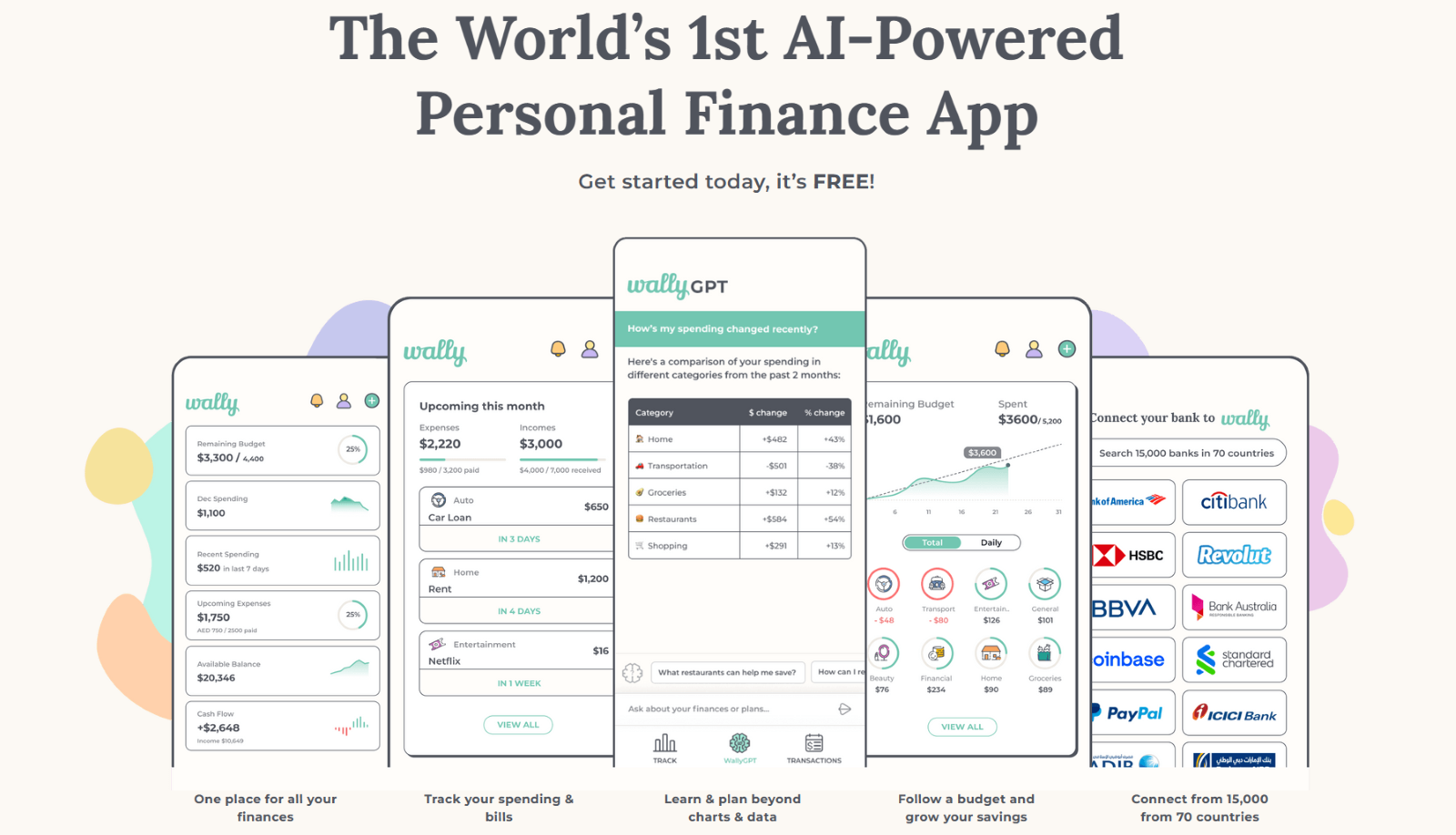

Wally is the world's first GPT-powered personal finance app available for download on Google Play Store.

The Wally app is derived from ChatGPT, the new personal financial assistant platform that organizes your finances with charts and statistics. Being an app formed from artificial intelligence, what sets it apart is the ability to ask direct questions for financial organization support. In this sense, Wally offers a personalized guide based on your needs and questions.

Anishu, Inc. - http://www.anishu.com/homebudget.html

The HomeBudget application allows you to organize your accounts, income, monthly budget, expenses, charges, all through graphs and a calendar.

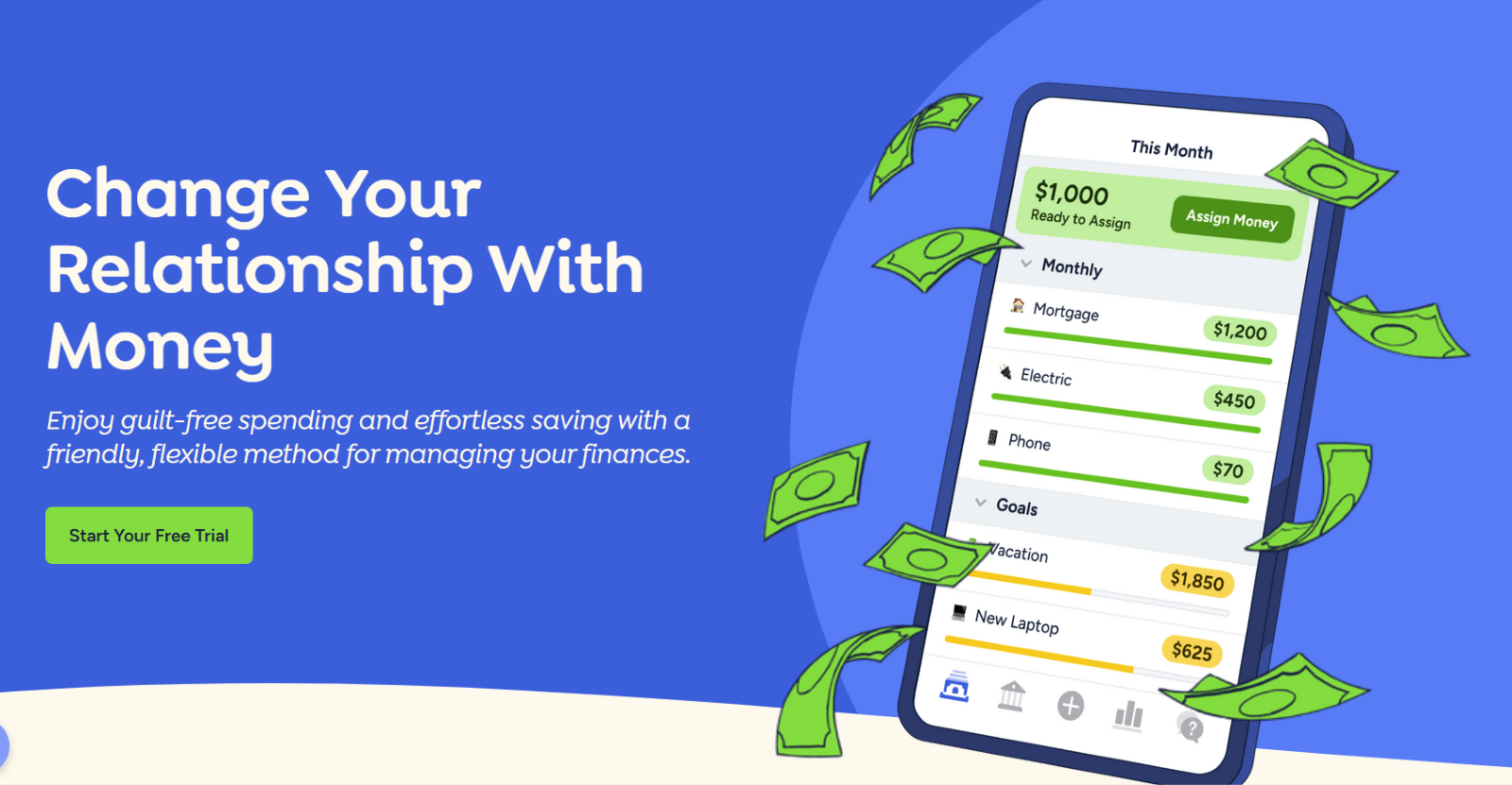

YNAB

In the YNAB application, there are several tools that allow you to organize your portfolio, such as: associating your bank accounts directly, accessing on various devices, sharing management with another partner and splitting bills, customizing everything to your liking, accessing a loan calculator and reports of your expenses.

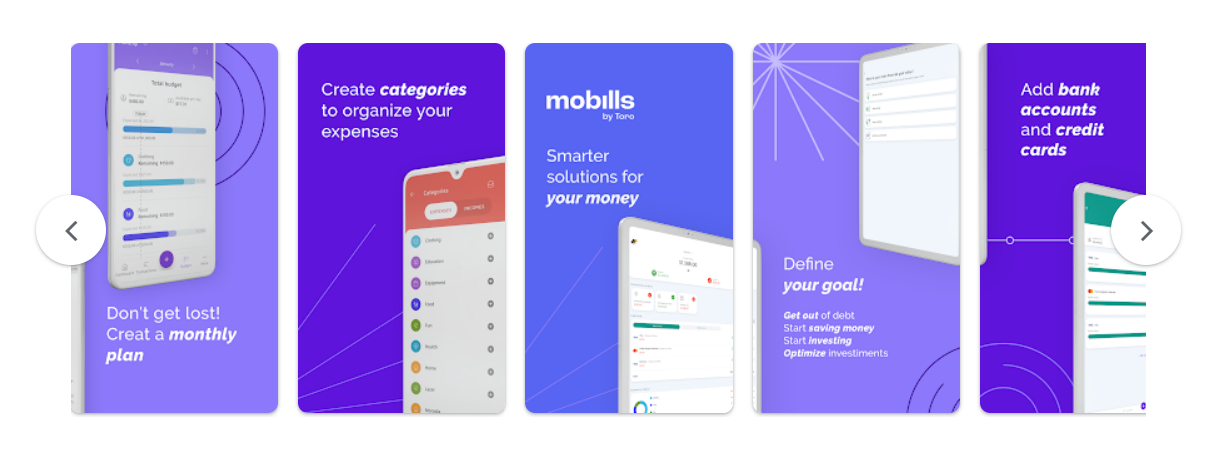

Mobills: Financial Control - Apps on Google Play.

Mobills is an application that promises to help you with your expenses and personal finances, so you can achieve financial freedom. It provides simple tools that allow you to manage your income by categorizing expenses, in order to save and save money.

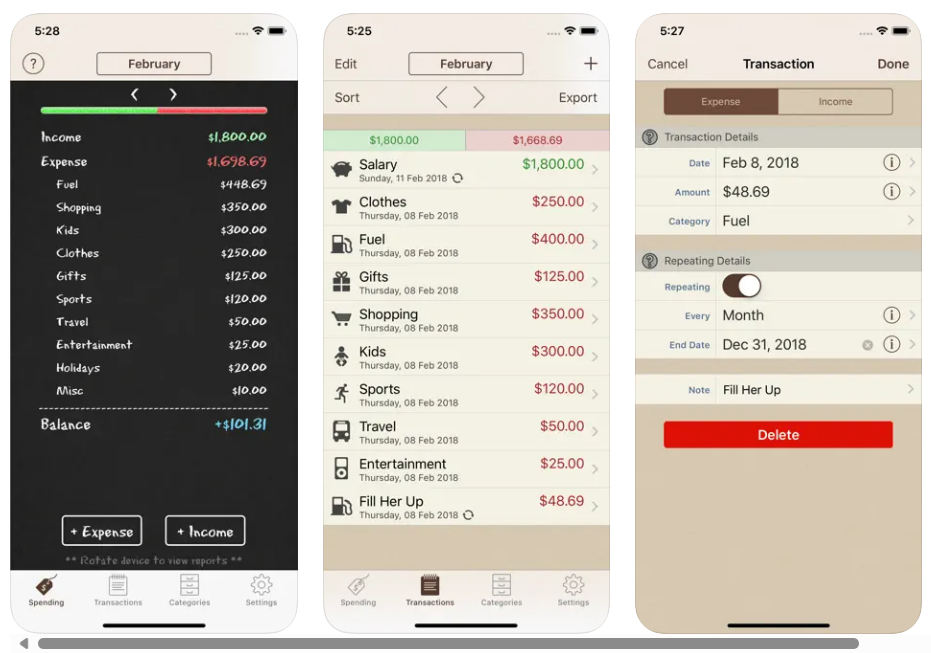

Spending Tracker on the App Store (apple.com)

The Spending Tracker allows you to set weekly, monthly, and annual budget goals, encouraging you to save as much as possible from budget to budget. The app tracks all your expenses, allowing you to see expenses as a whole and through reports. The entire application is customizable, including category icons.

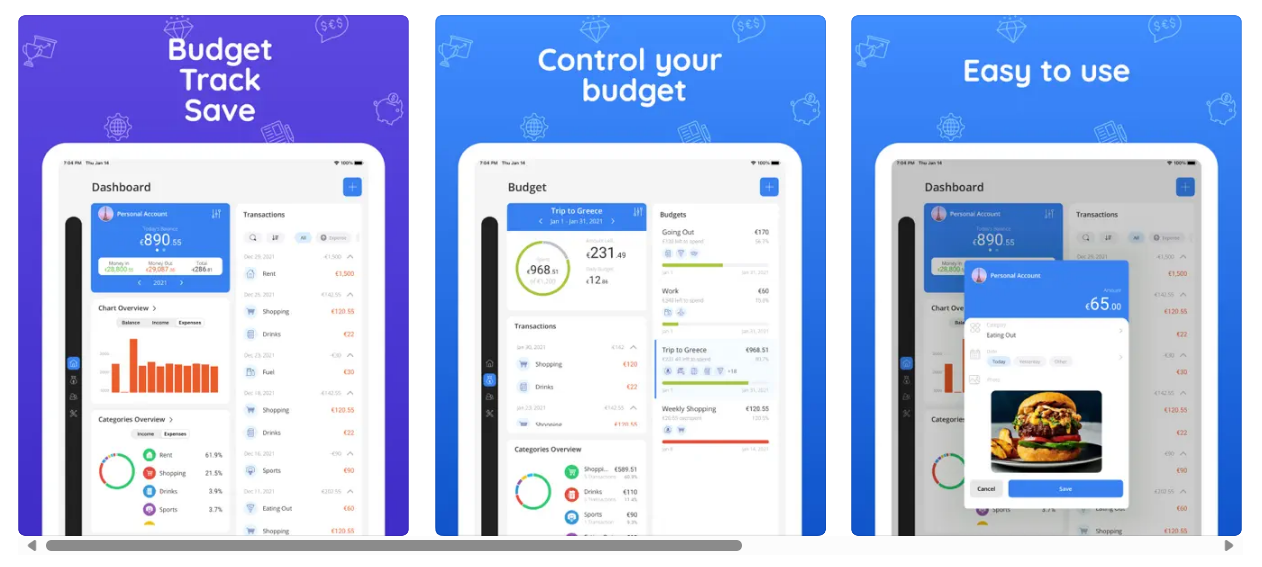

Moneyboard Budget Planner Bill is available on the App Store for budget planning and managing bills. Get it here: https://apps.apple.com/us/app/moneyboard-budget-planner-bill/id625887028.

The Moneyboard Budget Planner Bill app allows you to organize your finances with a greater focus on the visual aspect. Not only through graphs, but also images. You can add photos that illustrate your expenses, which helps you put your expenses into perspective and be more aware of what you spend.

If, when organizing your wallet, you realize that you are paying high installments for loans or insurance that could be lower, turn to a credit intermediary/insurance mediator. The Poupança no Minuto offers both services for free to help you renegotiate with the contracting entities your current products.