How to validate IRS invoices on the e-Fatura portal? Step by step

Do not know how to proceed with invoice validation on the e-Fatura portal? We explain step by step how to validate and the purpose of this process.

Do you need to save money? Saving is our first name. Contact a credit intermediary or insurance mediator from Poupança no Minuto and find out how you can lower the installments of these contracts!

But read, then, our guide to validate IRS invoices.

Why do I have to validate the invoices and until when?

The deadline to validate your IRS invoices on the e-Fatura portal is approaching: February 26th. It should be a task to be done throughout the year, in this case 2023, but most taxpayers leave invoices pending until this month.

Firstly, you should know that validating the invoices allows you to benefit from the maximum deduction limits in various categories: health, education, housing, retirement homes, and general family expenses (included in the "other" category).

In addition, you can also get back part of the VAT related to expenses such as transportation passes, accommodation, dining, car and motorcycle workshops, hair salons, beauty institutes, as well as veterinarians.

The e-Invoice portal automatically inserts most of the invoices, but you should always validate them, as some require you to manually enter the category they belong to.

So, summarizing: all purchases of goods and services that you make, whose invoices you associate with your tax identification number (NIF), will appear in your e-Invoice portal account. You must validate them by the 26th, in order to pay less income tax or receive a higher refund, depending on the case. But let's see, step by step, how to validate the invoices.

How to validate invoices step by step

Step 1

First, you must access the e-Invoice portal and click on "Deductible Expenses in IRS";

Step 2

Secondly, to log in, you must click on "Acquirer" in your personal area.

Step 3

Now, you will be directed to the login page of the Finance Portal, where you must enter your login details: tax identification number (NIF) or taxpayer number, and the respective password.

Step 4

When logging into your account, you will come across your deductions for IRS through your invoices, and to validate them, you must select the "Additional Invoice Information" option.

Step 5

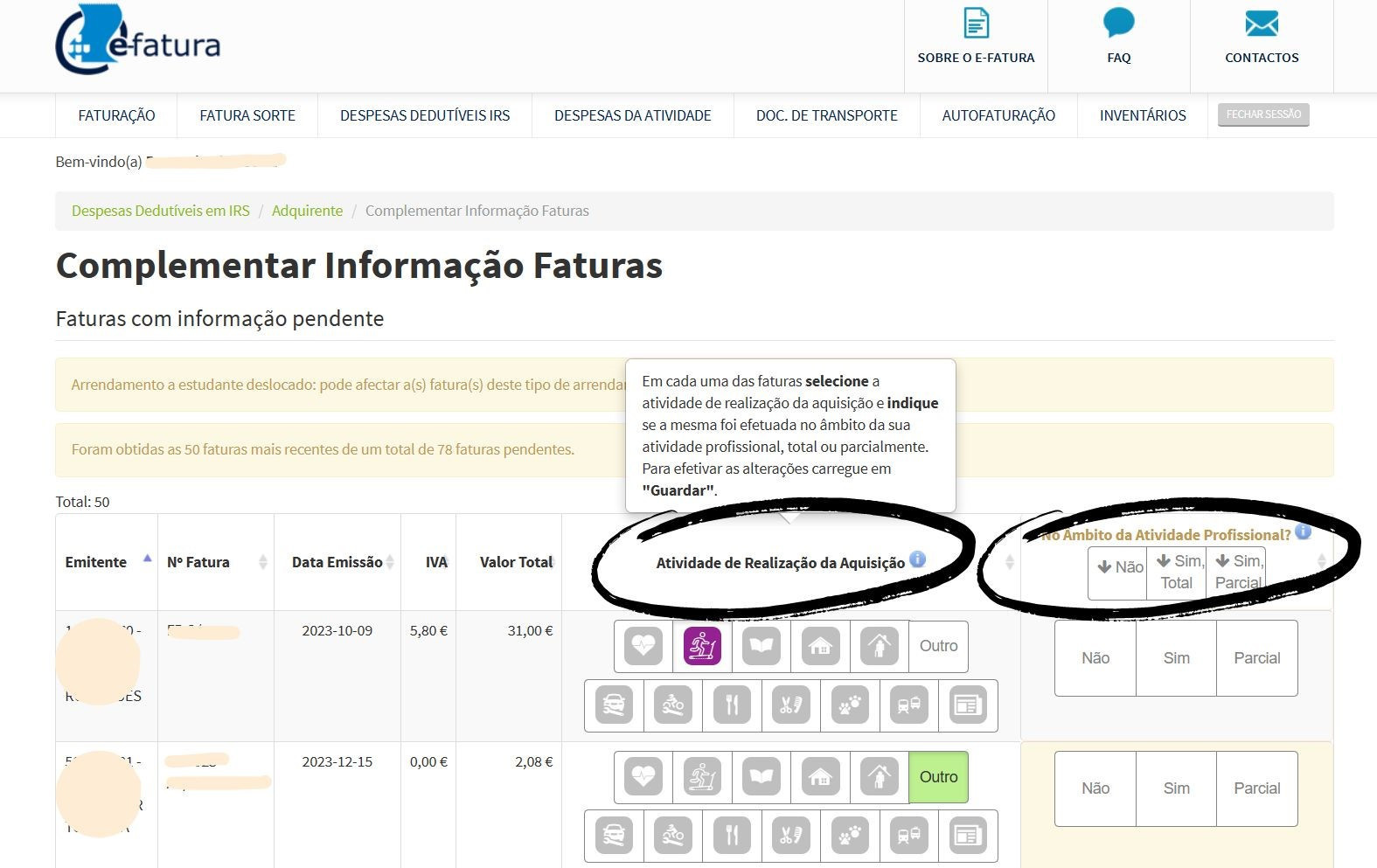

Now you can start validating your invoices. In other words, all invoices that do not have an assigned category must be associated with one by selecting one of the options in the categories that corresponds to them. If the entity name is not clear to you, search for the name to understand what expense it corresponds to.

In addition, if you have open activity (submitting self-employed worker receipts), you will see the second column in the image, where you will have to indicate whether each invoice was made within the scope of professional activity or not, or if it was partially.

In the end, don't forget to select "Save" to save all the validations you made on the invoices;

Step 6

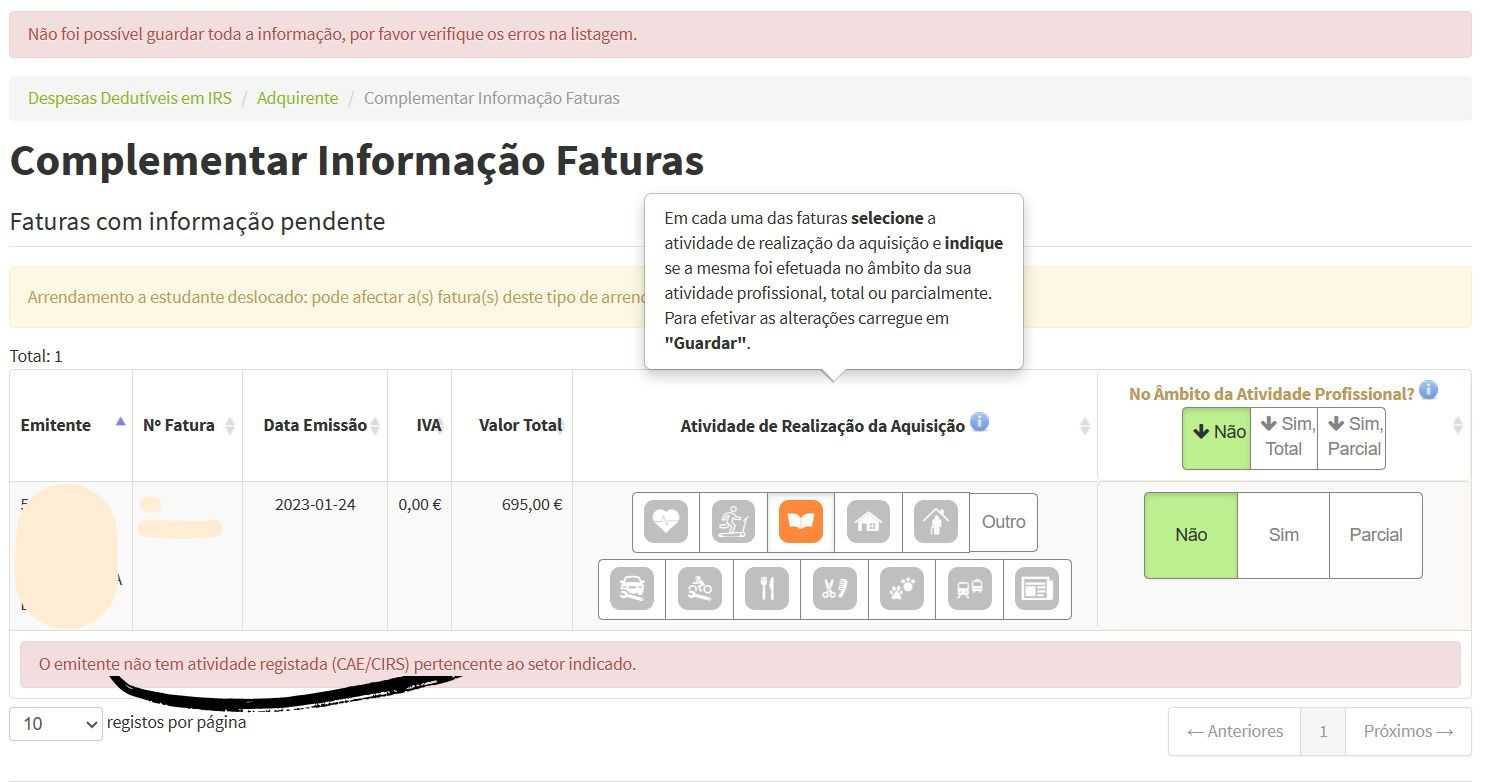

If, after validating all invoices, you encounter this error, it means that the invoice you associated with a category does not belong to that category and should change it - if the specific category does not exist, select "Other";

Step 7

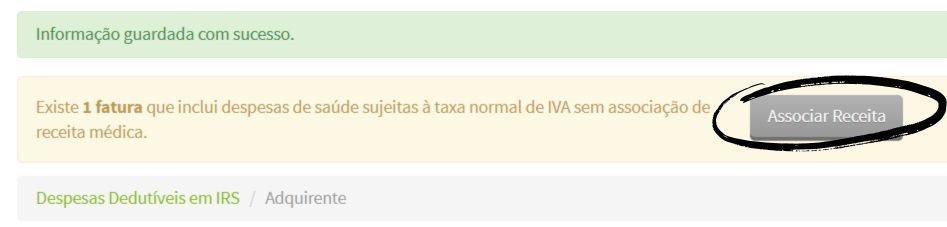

If you have invoices related to pharmaceutical revenues, you may see the following notice:

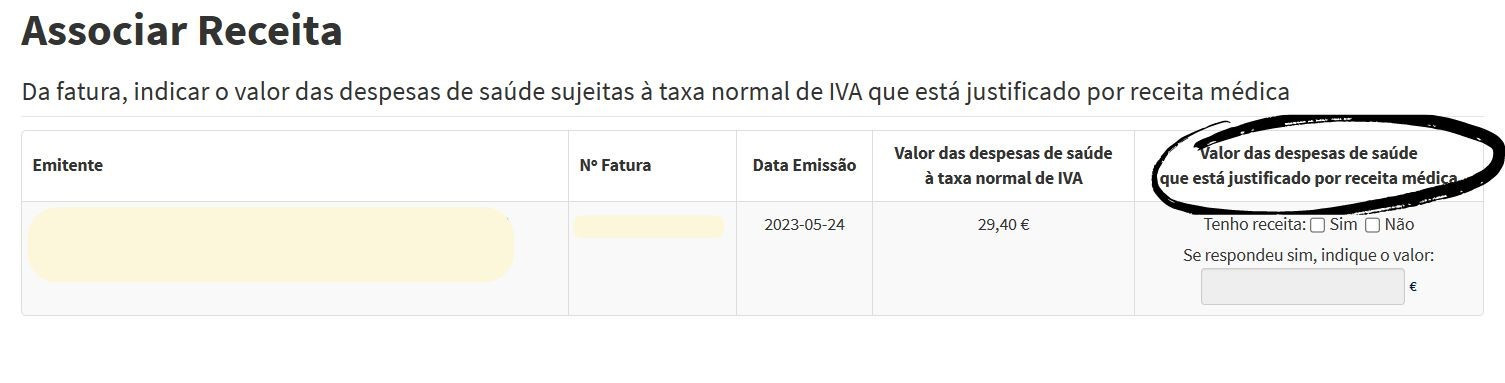

In this case, if you have the recipe in question, you can associate it, indicating the subsidized amount in the following field:

Finally, save the changes made and have all your invoices validated.

In case of not validating the invoices, there is no penalty, but the invoices not validated are excluded from being deductible in IRS, which could result in losing money compared to the refund that would have been received or the increase in the amount to be paid.

If you need to save, you already know... It's with us! Contact Poupança no Minuto and have access to free credit intermediation and insurance mediation services to save with your contracts!